Big Long plays out

In this discussion from January 2026, Marty of TFTC and Scott analyze a historic short squeeze in the silver market which has recently catapulted from the high 20 USD range to over 118 USD - a factor of 6 multiplier. The conversation delves into the structural failures of the global derivative complex, the insolvency of major European financial institutions, and the broader geopolitical "economic war" between the United States, China, and the central banking establishment.

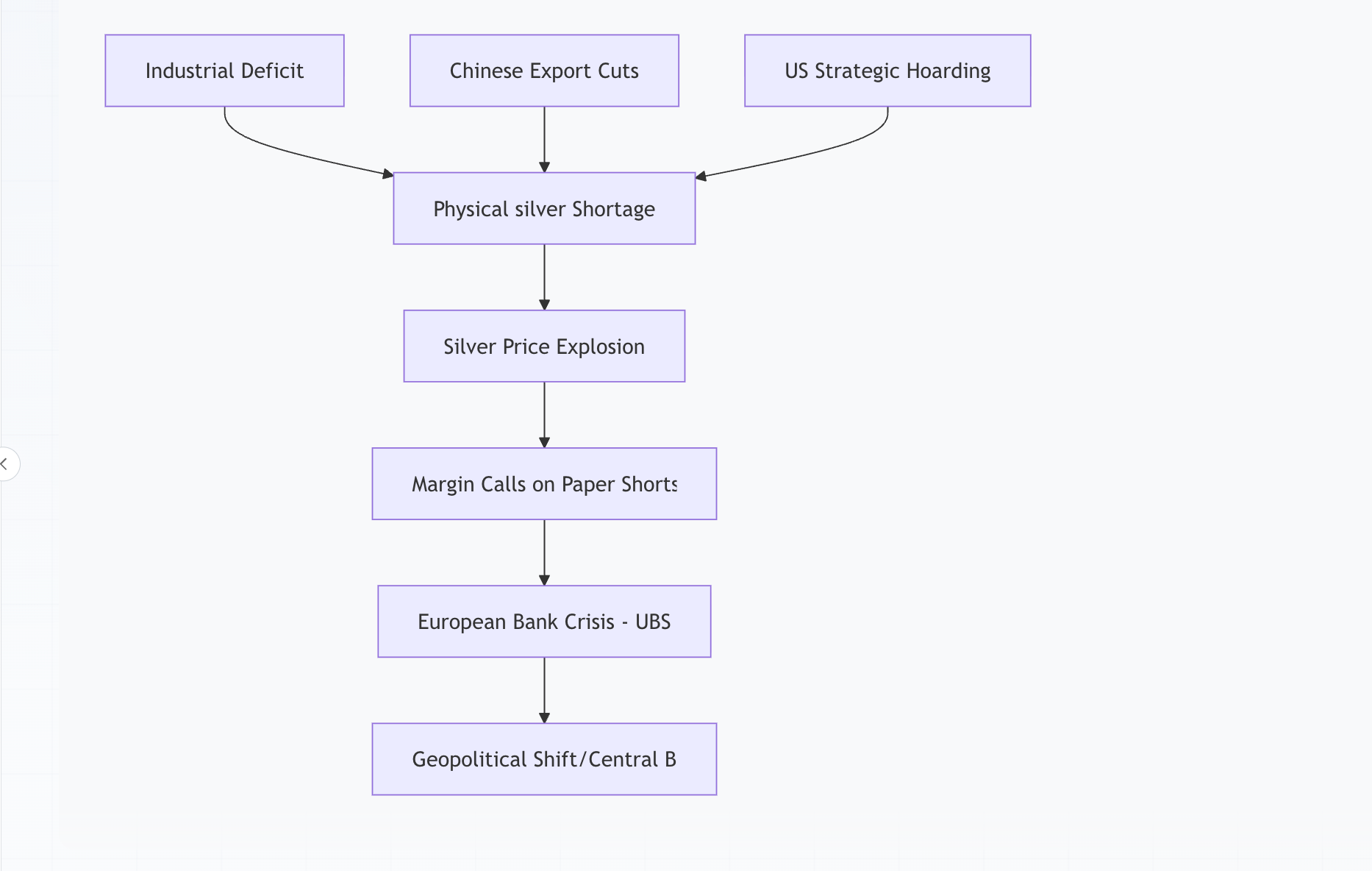

The Mechanics of the Silver Squeeze

The primary driver of the current market volatility is a structural deficit in silver supply. Scott explains that industrial demand—driven by solar energy, high-end electronics, and battery production—is significantly outpacing mining output. Unlike previous speculative bubbles, this move is underpinned by "price-insensitive" buyers. Market manipulators who have been structurally "short silver" for decades are now caught on the wrong side of the trade.

Industrial vs. Derivatives Demand

Companies like Tesla, Samsung, and Nvidia require physical silver to maintain production lines. If they cannot acquire the metal, their factories stop. Consequently, these firms are bypassing traditional exchanges like the Comex to buy directly from mines in South America.

The "Big Long" is playing out because the underlying asset is no longer available to be borrowed or leaned out. Lease rates for silver have exploded, signaling that the "paper" market is disconnected from physical reality. Scott suggests that the over-the-counter (OTC) market may be hiding 5 billion ounces of short interest, a figure so large it could bankrupt the world's most prominent trading desks.

Banking Stability and the European "Bodies"

A recurring theme in the discussion is the expectation of "bodies floating to the surface"—a metaphor for the inevitable bankruptcy of major banks caught on the wrong side of the silver trade. Scott identifies UBS as a prime suspect, noting that the bank inherited a "ticking time bomb" when it acquired Credit Suisse in 2023.

The Credit Suisse/UBS Connection

UBS is currently managing toxic debt and "meme stock" short positions (such as GameStop) originally held by Archegos and Credit Suisse. The rapid rise in silver prices may be the "final nail in the coffin" for the Swiss banking giant.

Scott posits that this squeeze might be a coordinated effort by the Trump administration to weaken the European Central Bank (ECB) and the City of London. By allowing or encouraging the price of silver to rise, the US effectively puts the European banking system—which is heavily intertwined with the silver derivative complex—into a terminal liquidity crisis.

Geopolitical Turmoil and Economic War

The silver squeeze is framed as a single front in a larger economic "hot war." The participants suggest that China’s decision to cut silver exports was an opening salvo, intended to squeeze US industrial production.

Key Geopolitical Tensions

- Greenland: Military and economic maneuvering in Greenland is linked to the control of strategic mineral supplies.

- Japan: The Japanese yield curve is "blowing out," suggesting that the Bank of Japan can no longer control interest rates. This forces Japanese investors to repatriate capital, further destabilizing the US bond market.

- US vs. BIS: The Trump administration is seen as being in direct conflict with the "globalist" central banking order, including the Federal Reserve, the ECB, and the Bank of International Settlements (BIS).

Institutional Fraud and "Fiscal Dominance"

The discussion takes a sharp turn into the domestic stability of the United States. Marty and Scott highlight the "looting the treasury" stage of the late-stage empire. They cite Elon Musk’s claim that roughly 50 percent of the US government budget, or 3.5 trillion USD, is lost to overt fraud.

The Breakdown of Law and Order

The unearthing of massive Medicaid and social program fraud in states like Minnesota and California is viewed as a symptom of a collapsing system. Scott argues that the US has shifted from "monetary dominance" to "fiscal dominance," where the government prints money not to stimulate the economy, but to paper over institutionalized theft.

They conclude that the system is currently in a "crack-up boom." To avoid a deflationary spiral, the government must continue to print money to fund fraud and interest payments. However, this leads to hyperinflation, eventually making the currency worthless.

Bitcoin: The Final Off-Ramp

As the silver market breaks and the banking system faces insolvency, Bitcoin is positioned as the only viable exit for both retail and institutional capital.

The Threat of "Bail-ins"

Scott introduces a contrarian take: the next crisis may not be solved by "bailouts" (printing money to save banks) but by "bail-ins" (seizing depositor funds). This was seen in Cyprus in 2013 and could be the primary tool used to recapitalize failing banks in 2026.

Because Bitcoin exists outside the traditional financial rails, it serves as a measure of global liquidity. While its price has recently fluctuated below 90,000 USD, it remains the only asset where a billion USD can be moved across borders and out of the "reach" of failing banks in under an hour.

Surprising Insights

The conversation yielded several provocative conclusions that differ from mainstream financial analysis:

- US Strategy against Europe: The theory that the US Treasury may be intentionally allowing silver to rise to "defang" European central banks and the City of London, potentially creating a path for a US-centric hard money reset.

- The "Hostage Video": A reference to Jerome Powell’s recent public address, which Scott describes as a desperate attempt to maintain the Fed's "independence" in the face of a Trump administration lawsuit.

- The "Six Sigma" Event in Japan: The blowout of the Japanese yield curve is treated as a precursor to a global deleveraging event that will expose "structural insolvencies" worldwide.

- Civil War through Economics: The suggestion that the political and economic friction in places like Minnesota constitutes a "civil war" where only one side is currently fighting, primarily through the subversion of law and order and the use of massive financial fraud.

Conclusions

The discussion concludes with a warning that 2026 will be a year of radical volatility. The "normalcy bias" of the last two decades is being shattered by patterns that have no historical parallel outside of the Weimar Republic.

Recommendations for Navigating 2026:

- Deleveraging: Avoid debt at all costs. Leverage is what kills participants during a "crack-up boom."

- Hard Assets: Silver is undergoing a "structural repricing" that could see it reach 200 USD or 300 USD if force majeure events occur on the Comex.

- Self-Sovereignty: Keep Bitcoin in cold storage. In a "bail-in" scenario, money in a bank is no longer an asset; it is a liability of a failing institution.

- Sober Realism: Admitting "I don't know" is safer than relying on outdated 20th-century market models.

Ultimately, Marty and Scott agree that the "money is broken," and until the world returns to a hard money standard—whether through silver, gold, or Bitcoin—the cycles of fraud and geopolitical conflict will only intensify. The collapse of the dollar is seen not as a possibility, but as a mathematical certainty of the current trajectory.