Currency Wars, Power Struggles & Regime Change

In this comprehensive broadcast from early 2026, Simon Dixon provides a deep-dive analysis of the shifting global power structures, focusing on how "Big Money" utilizes geopolitical theater to mask massive wealth transfers. Dixon frames the current environment as a transition into a multipolar world order defined by Fiscal Dominance, where traditional state sovereignty is being traded for a transnational grid managed by financial, military, and technical industrial complexes.

Part 1: Bitcoin and Technology: The Five Currency Wars

Dixon begins by identifying five major currency wars that are currently reshaping the global financial landscape. He argues that the Financial Industrial Complex (Fick) uses sanctions as "Financial Weapons of Mass Destruction" to inflict pain on ordinary citizens, forcing them away from local currencies and into digital dollar rails or surveillance-heavy stablecoins.

The Five Currency War Fronts

Dixon focuses heavily on the Clarity Act, the US legislation markup released in January 2025. He provides a "good news/bad news" dichotomy for Bitcoiners. The good news is that the Act explicitly carves out protections for self-custody and peer-to-peer transactions, recognizing Bitcoin as property rather than a security. However, the bad news is the expansion of the "Technical Industrial Complex" (Tick). The Act seeks to integrate stablecoins and tokenized assets into a 1984-style control grid, using the "Travel Rule" and Bank Secrecy Act to monitor every movement of digital value.

The section concludes with a warning about Michael Saylor and Wall Street’s "Bitcoin ETFs." Dixon views these as tools for the centralization of Bitcoin. By getting individuals to give up their private keys in exchange for a stock ticker, the Fick can eventually implement fractional reserve Bitcoin, undermining the scarcity that makes the asset valuable.

Part 2: Macroeconomics: The BlackRock, Trump, and Fed Power Struggle

In the second section, Dixon deconstructs the theater between the Trump administration and the Federal Reserve. He describes a state of "Fiscal Dominance," where monetary policy is no longer independent but is instead subservient to the government's need to roll over massive debts and fund the AI transition.

The Federal Reserve "Hostile Takeover"

Dixon speculates on the power struggle between Jerome Powell, representing the old banking orthodoxy, and the likely installation of Rick Rieder (BlackRock’s CIO) into the Federal Reserve leadership. This shift marks the transition from bank-centric power to asset-manager-centric power. The goal is to drive massive Capital Expenditure (CAPEX) into AI data centers and robotics. As AI energy needs climb from 2% to 12% of the US power grid, the credit markets require a new manager who can suppress interest rates for the Fick while letting the longer-term debt burden fall on the citizens.

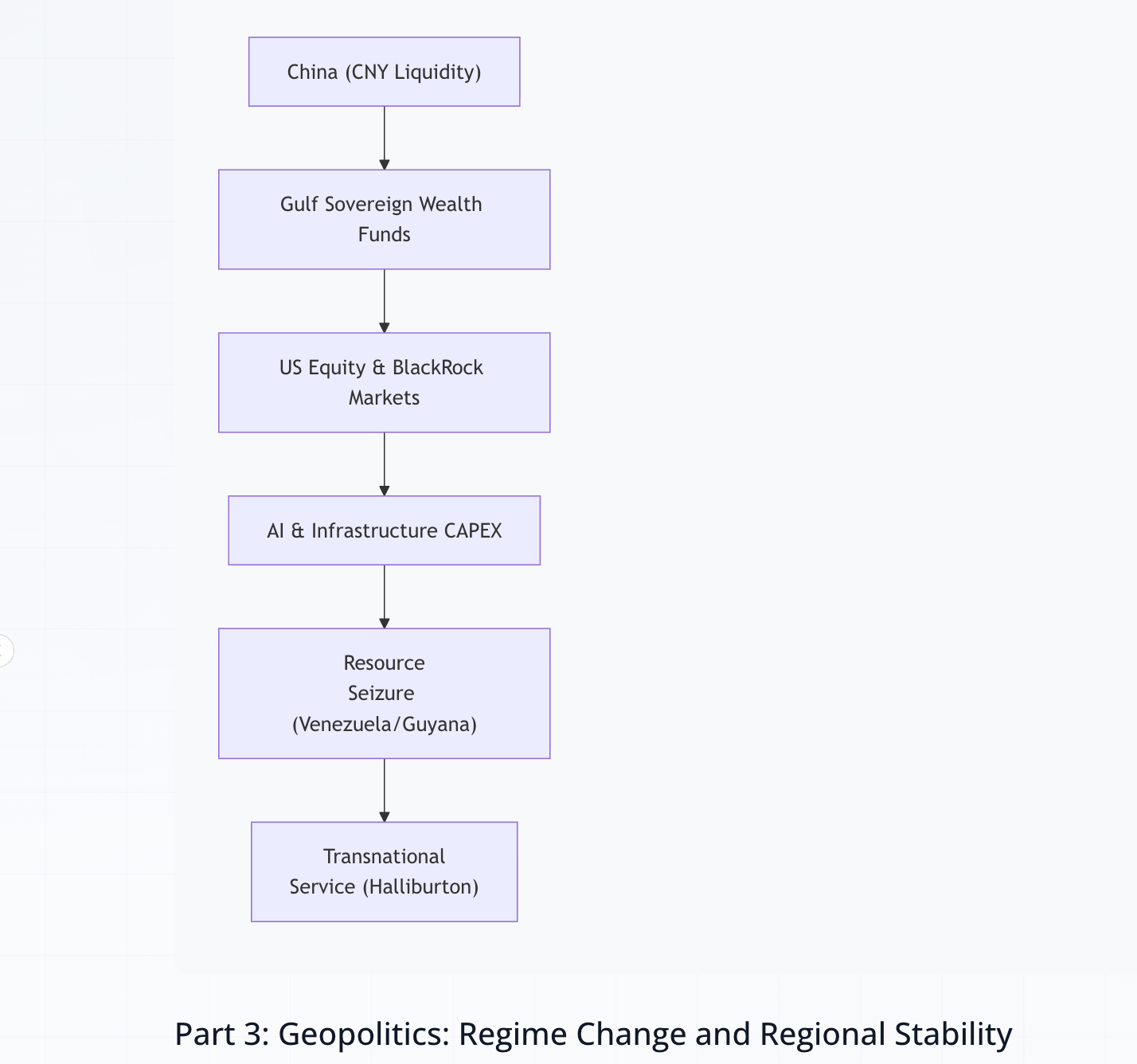

Transnational Capital and the Rental Militia

Dixon identifies a "Transnational Capital Loop" that dictates US foreign policy. China, having won the trade war, buys oil from Gulf nations using the CNY. This liquidity fuels Middle Eastern Sovereign Wealth Funds, which then reinvest the profits back into US Equity and BlackRock-managed funds.

The US Military, in this framework, has become a "Rental Militia." Operations like the January 2025 intervention in Venezuela were not about "democracy" or "drugs" but about securing the world’s largest oil reserves for this transnational cycle. Interestingly, Dixon notes that companies like Chevron and Exxon were authorized to continue selling Venezuelan oil to China at a discount, proving that the "Geopolitical War" is a cover for resource management.

The Silver and Gold Squeeze

Dixon reports on a massive silver squeeze occurring in 2026, driven by China’s new export licensing requirements. As the dollar weakens (denominated in hard assets), Gold has surpassed 4600 USD and Silver has spiked near 100 USD in Asian markets. This arbitrage is breaking the "Japan Carry Trade," causing Japan to raise interest rates while the rest of the world lowers them, which Dixon sees as the final nail in the coffin of absolute dollar dominance.

Part 3: Geopolitics: Regime Change and Regional Stability

In the final section, Dixon puts the "theater" of war into perspective, comparing current events to CIA declassified documents from the 1953 Iranian coup (Operation Ajax) and the Iran-Contra affair. He argues that modern "regime changes" are coordinated transitions intended to move the world toward regional stability for the benefit of global trade.

The Middle East: Regional Stability vs. Forever War

Dixon posits that we are witnessing the end of the "Forever War" model. The Gulf nations (UAE and Saudi Arabia), propped up by Chinese money, have negotiated a "Regional Stability Alliance."

- Iran: Dixon views the internal unrest in Iran as a "shedding of proxies." Iran is dropping Hezbollah and Hamas to integrate into the GCC (Gulf Cooperation Council) trade rails. This is a managed transition, not a chaotic revolution.

- Israel: Dixon argues that Israel is being "utility dumped" by the Military-Industrial Complex (MIC). As US debt-to-GDP makes forever wars unsustainable, Israel must negotiate its place in a Gulf-led economy.

- Somaliland/Somalia: The UAE is using military theater to secure strategic ports in the Red Sea, effectively replacing US dominance over these trade maritime routes.

The UK and Western Subordination

Dixon highlights a massive "Identity Crisis" in Europe and the UK. While media narratives push themes of "invasion" or "civil unrest," billions of EUR and GBP are being exfiltrated to Dubai. The UK's new tax laws on global wealth have caused a millionaire exodus. This allows the Gulf Sovereign Wealth Funds to buy up distressed UK real estate and assets at a discount—a form of "Asset Stripping" the West.

The "Sovereign Wealth Builder" Solution

Dixon concludes by defining the mission of the "Sovereign Wealth Builder." He suggests that since political solutions are dead (as both sides are part of the pay-to-play Fick), individuals must take personal responsibility for their sovereignty.

Major insights include:

- Refuse the Narrative: Recognize that 1984-style surveillance is being implemented under the guise of "national security" or "crypto regulation."

- Boycott via Self-Custody: The only way to stop the Fick from using your wealth to fund wars and ethnic cleansing is to remove it from the banking system via self-custodied Bitcoin.

- Debt Resistance: Avoid loans and leverage. These are the hooks that the Fick uses to strip assets from individuals during "managed volatility."

- Focus on Real Assets: In a multipolar world, only the "hardest" assets (Bitcoin, Gold, Land) will survive the strategic weakening of the US dollar.

Dixon predicts that Trump will likely be awarded a Nobel Peace Prize for the Middle Eastern "stabilization," but warns that this peace comes at the cost of total fiscal dominance and the end of the traditional American middle class. His final exhortation is for his community to "resist proof-of-weapons with proof-of-work," and to remain vigilant as the Technical Industrial Complex builds the next digital iron curtain.