14 - Get Ready - Phoenix is an easy option...

Recently, quite a few people have been asking me about Bitcoin and how to get started with it practically - in real life. I put this summary together to explain the most important things that you need to know and I try to answer the most common questions. Hopefully you can use this as a handy reference guide. Feel free to refer others to the page to learn as well and to reach out to discuss with me if anything is not clear or you still have questions. There are pointers at the end to other educational resources as well.

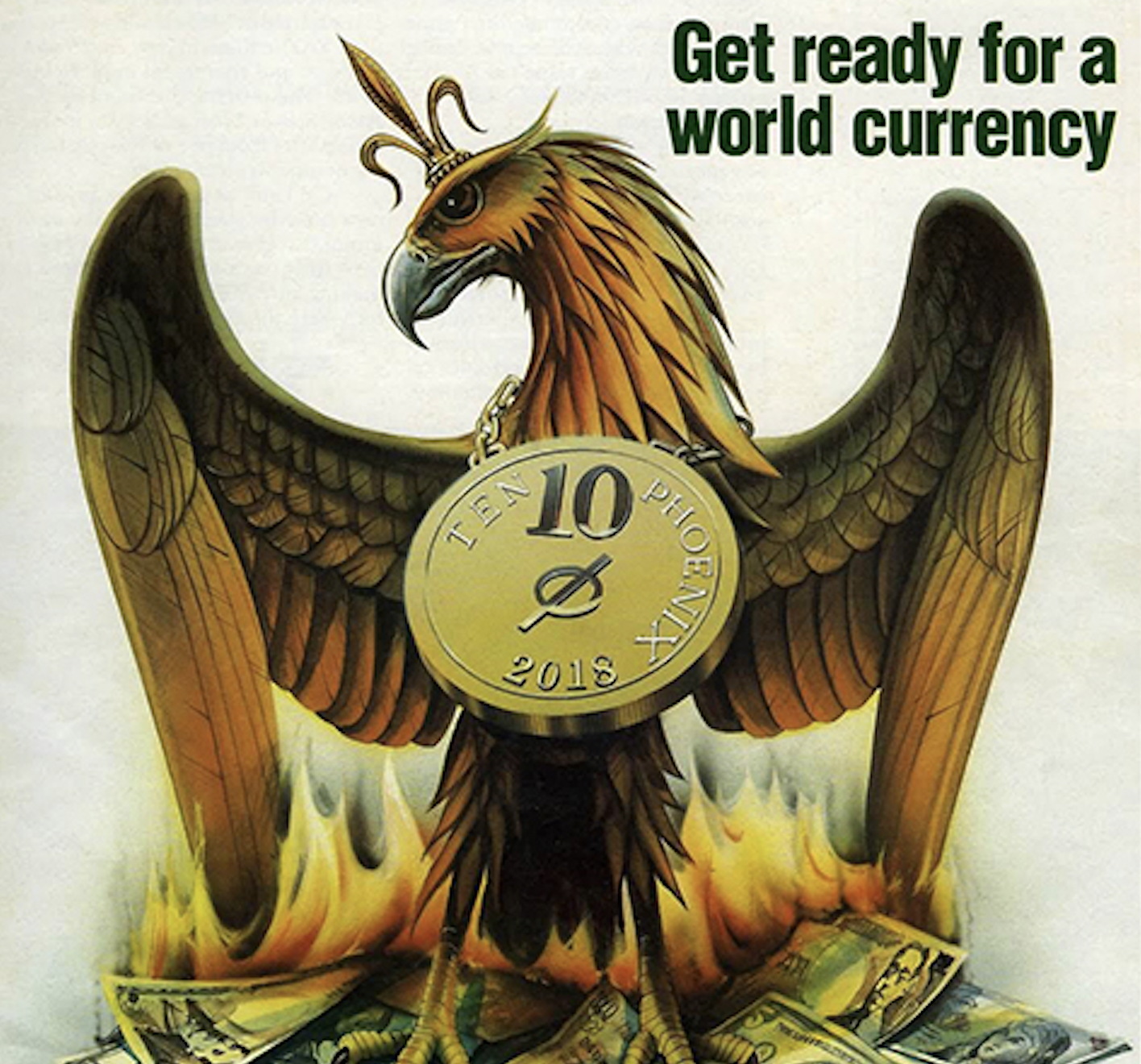

The picture above is interesting - it appeared on the cover of The Economist of

8 Janaury 1988 - also interesting reading is their issue of 31 October 2015 and this article explaining how the technology behind bitcoin could transform how the economy works. For more on The Economist's "uncanny ability" to predict what's coming read "A Closing Thought" in Issue 8 of the newsletter.

What is Bitcoin - and why is it more interesting than cash?

Bitcoin is a "Bearer Asset"; it has value in the same way that a bearer bond or gold coin has value - it is yours if you have possession of it and you can do what you want with it. It is digital hard money.

More interesting than gold coins is that any bitcoin you own can be easily divided into smaller amounts and exchanged as part of any transaction for value. Each bitcoin can be divided into 100 million parts called "satoshis" or "sats". Currently (May 2022) there are about 2,500 sats in one US Dollar so one US Cent is about 250 sats. One UK penny is about 300 sats.

[ Update of Aug 2024: There are now 1,700 sats in one USD, so one US Cent is about 170 sats. One UK penny is about 220 sats. Bitcoin has appreciated by 35-45% over the national currencies in this period. You could also say your national currencies have devalued by 35-45% over this period.]

You can easily transfer bitcoin that you own to anyone using an app on your phone or computer. Transactions like this can be done for a few US cents or even less and without anyone else being involved. Bitcoin is like cash (but better) - it's yours if you hold it yourself and you can do what you like with it.

Bitcoin that you hold cannot be devalued by governments printing more currency like they do with your pounds, dollars and euros today. As such Bitcoin really is a better and harder form of money and over time it will increase in value over the weaker forms of money.

Where does bitcoin come from?

New bitcoins are created by the bitcoin network every 10 minutes or so and given to the Bitcoin Miner who succeeds in adding the next block of transactions to the blockchain that is the public record of all transactions since inception. Currently about 6.25 BTC are issued for each new block; each 4 years the amount issued drops by half. This "halving" will next happen in early 2024 when it drops to 3.125 BTC per block. You should be able to spot a decreasing inflation rate!

Unlike with your fiat currency - nobody can change the issuance rate or make additional bitcoins - so this is genuinely "hard money".

How do you get bitcoin?

To get bitcoin, you need to exchange something of value with someone who has bitcoin and wants to trade with you. The value that you exchage can be any goods or services (your time and effort) or money like Dollars, Euros or Pounds. You trade using an online exchange like Binance, Coinbase or Kraken or with any individual or company who wants to trade "peer to peer" with you. You simply agree the conversion rate and do the trade. See below for the practical steps. An account can be set up in about a week - for all of these you will need to do KYC and share your personal identification documents (the risks of, and irrational arguments for this are topic for another newsletter).

How do you get cash from your bitcoin?

It is the opposite of getting bitcoin! You can trade peer to peer with other people or you can go via an exchange. Peer to peer, you agree the exchange rate - you transfer bitcoin to them and they give you cash at the agreed exchange rate. If you use an exchange you convert your bitcoin to traditional money and instruct them to transfer the euros, dollars or pounds back to your bank account (they will charge you for this). Note that Binance does also have an iteresting service to facilitate peer-to-peer trading.

If you use Phoenix Wallet as suggested below you can easily transact using traditional currency amounts (pounds, euros and dollars) and behind the scenes the wallet transparently coverts into bitcoin transactions - it could not be more simple! It's like magic - and it just works.

Practical points and guidance

The easiest way for most people to get their first bitcoin is to sign up to an online service like Binance, Coinbase or Kraken and to create an account with them into which you will transfer some traditional fiat money to convert into bitcoin. Kraken is nice with low fees and it allows withdrawal by lightning!

- I do recommend watching Guy's explainer on Binance and he has a separate one on Coinbase

- Kraken has many Educational Resources here

Trading peer to peer

Another way is to find someone who wants to sell you bitcoin in exchange for money or other goods and services. You agree the exchange rate and you make the exchange directly with them. This is just like finding someone who wants to exchange their euros for your pounds or vice versa - or finding who someone agrees to cut the lawn or clean the windows for a fee. Over time this will become increasingly common.

- you can keep your bitcoin with a custodian like Binance, Coinbase or Kraken - even some banks start to offer this service(!). Keep in mind that custodial services have counterparty risk - the company that holds the asset in your name might restrict your access to it at some future time for any one of many reasons.

- alternatively you can keep it yourself in a bitcoin wallet. This is called Self Custody and is strongly encouraged as best practice. You take full responsibility for the safekeeping of your bitcoin. This is like keeping cash in the wallet in your pocket or keeping your gold coins at home in a safe.

- You choose what works best for you - the Phoenix Wallet that I describe below is a sort of hybrid solution - it is a Self Custody service but it also has a number of benefits that you get from a custodial service. I use it and can recommend it.

Sending and receiving bitcoin

You can send bitcoin "on chain" or "via Lightning"

- On-chain is a bit like sending a SWIFT message. Use this if you are sending a large amount (many hundreds or thousands of pounds/dollars worth).

- Via Lightning is more like using cash or having a "tab open" at the bar or a shop. Use this for smaller amounts from a few pence or cents to a few hundred pounds, euros or dollars. Generally you will prefer to use Lightning for smaller amounts - you will find it faster and cheaper - even more convenient than using Credit and Debit Cards or online payment services like Paypal, Venmo and Wise.

Phoenix Wallet

Phoenix Wallet (from the French company, ACINQ) is one of the easier ways for you to get started with bitcoin and learn how it works. This is good for amounts from a few pence/cents up to a few hundred pounds, euros or dollars. Phoenix Wallet allows you to send and receive on-chain and via lightning - it does it all!

- Download the Phoenix Wallet App on your phone - iPhone and Android

- Open the app and Create your wallet on your phone

- Do follow their instructions, FAQ and explainer - set aside 10-15 minutes and do this carefully

- Ensure you have written down and keep safe the 12 word seed phrase. This allows you to restore your wallet if you change or loose your phone. The 12-words are like the key and certificate to a safe deposit box. Anyone that you share this with will have full access to the bitcoin in your wallet. Best practice is to write it down on a couple of sheets of paper and to store these safely in a couple of locations that only you know and will be able to remember and have access to in future if you need.

Never take a photograph of the 12-words or upload them to online services; there is always a risk that online services can be hacked in future and your keys are not safe online. - On iPhone, you can choose to let Apple store your 12 word phrase in iCloud. This can make it easier if you loose or change your phone. Drawback is that you must trust Apple to keep the 12 words safe. Governments have been known to interfere with such Apple services. Your choice.

For larger quantities of bitcoin other best practices and tools apply - this can be subject of another newsletter - let me me if you are interested to know more.

Lastly - put some bitcoin "in your wallet". Simply select Receive and "show a bitcoin address" - use this address to send bitcoin from your exchange or give it to whoever you are transacting with and they will give you bitcoin in return for what ever value you agreed - pounds, dollars or other services. You need to make this first transaction on-chain and ACINQ will charge a 1% fee or 3000 sats for it.

That's it - you are all set and ready to make your first transaction.

[Future Roger here in August 2024:

Tools that are currently available and recommended include:

- Kraken.com - the exchange as mentioned above and their iOS and Android apps

- Phoenix Wallet - great to get started with Lightning

- Breez Mobile - also great to get started with Lightning

- Aqua Wallet - another great starter tool - this is built on Liquid Bitcoin - it is intended for large scale deployment and includes USDT stablecoins that can be interesting. A complementary tool for this is Blockstream's Green Wallet.

- Fedi - very early days for this one but you could already try it out with a few 10's of pounds, euros or dollars and it has good integration with Lightning

- Cashu - also early days but this really is the leading edge in Chaumian eCash. Again I would encourage you to experiment with a few 10's of pounds, euros or dollars - and it has good integration with Lightning

- Sparrow Wallet - for larger amounts of Bitcoin you want to consider something like this and likely together with a hardware signer like Trezor or ColdCard to keep your key safe.

Feel free to reach out with any questions or suggestions. ]

What can I use bitcoin for?

You can use bitcoin for anything that you would pay cash for today. You just need to find someone who is interested to trade with you. This will become increasingly easy going forward. Some suggestions to start with

- peer to peer payments - eg splitting the bill at a restaurant or pub, paying rent or paying someone for groceries or other services that they provide for you.

- goods and services - increasingly people who take cash for payments will be comfortable (even prefer) to be paid in bitcoin.

- anything that you would buy with cash or credit card today. Going forward you will find that people and even companies will offer a discount if you pay with bitcoin to encourage this as a preferred means of exchange. Hard money wins out:

Gresham's Law VS Thiers' Law Simplified: Lessons Of History You Can't Afford To Ignore

Educational Resources

Bitcoin is "hard digital money". Recommended reading is Lyn Alden's article in which she tells the history of money, and examines this rather unusual period in time where we seem to be going through a gradual global transformation of what we define as money, comparable to the turning points of 1971-present (Petrodollar System), 1944-1971 (Bretton Woods System), the 1700s-1944 (Gold Standard System), and various commodity-money transition periods (pre-1700s). This type of occasion happens relatively rarely in history for any given society but has massive implications when it happens, so it’s worth being aware of.

If we condense those stages to the basics, the world has gone through three phases: commodity money, gold standard (the final form of commodity money), and fiat currency.

A fourth phase, digital money, is on the horizon. This includes private digital assets (e.g. bitcoin and stablecoins) and public digital currencies (e.g. central bank digital currencies) that can change how we do banking, and what economic tools policymakers have in terms of fiscal and monetary policy. These assets can be thought of as digital versions of gold, commodities, or fiat currency, but they also have their own unique aspects.

Read Lyn's full article: Lyn alden - What is Money - or see her discussing this with Peter McCormack

That's it!

No one can be told what The Matrix is.

You have to see it for yourself.

Do share this newsletter with any of your friends and family who might be interested.

Any questions or anything else? Feel free to comment below!

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.